What is PayTo?

PayTo is a digital payment solution that facilities real-time account-to-account payments. The solution sets to modernise the legacy Direct Debit (BECS) solution for requesting payments from your debtors. Unlike Direct Debits, PayTo operates 24 hours a day, 7 days a week, 365 days a year, even public holiday. No longer wait 2 days for funds to clear, be notified in real-time of availability of funds. PayTo sets to take Card Payments head on!

Check out the official PayTo Site and PayTo Help centre for further information and demonstration.

PayTo Use Cases

Card's have traditionally been used for businesses who need an immediate confirmation that the customer's can pay for the goods and services. PayTo is the challenger digital payments product, allowing for a debtor to make payment simply by using their BSB and Account Number. Some example use cases for PayTo are:

- Ecommerce Transactions

- Recurring Services (eg. Bills, Subscriptions and Memberships)

- Once-Off Services (eg. Ride Share, Food Delivery)

- Financial Product Payments (eg. Loans, Insurance)

Given PayTo's ability to provide real-time consents driven payments, this will be the preferred solution for consumers to make payment.

How can my Customer's use PayTo?

Australia's banking system is complex with almost 100 active banks operating in Australia. The majority of Retail Accounts are now live with PayTo, making payments from a Business Accounts is still in the process of being rolled out.

All you need now is Squarepay.

How does PayTo Work?

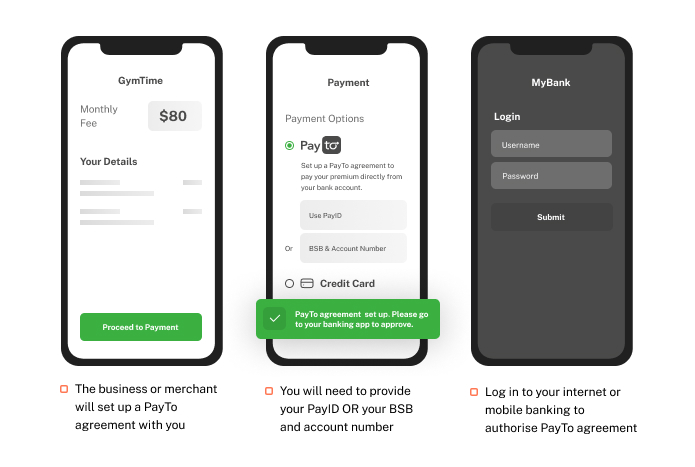

In order to use PayTo, you must first set up a merchant account with Squarepay. PayTo then simply works as detailed below:

- Collect your customer's BSB and Account Number (or PayID information).

- Create a PayTo Agreement (using Squarepay) with the associated Payment Terms.

- Customer will be notified to review and authorise the Pending PayTo Agreement in their desktop or mobile banking software.

- Payments can now be initiated instantly.